People in the financial and business sectors commonly use the term remit payment today when creating invoices, filling out banking forms, and using online payment services. But what does remit payment mean?

In simple terms, remitting money is to pass cash over to another person in order to pay a bill, a debt, or any other kind of financial obligation. It involves a person or business giving money for a specific purpose, usually recorded and managed in a bookkeeping or legal manner.

It is not just significant to the business but also to the other individuals who make or receive payments on a regular basis to understand the meaning of remittance payment. You can keep in mind that regardless of whether you want to pay an invoice, transfer money to relatives overseas, or operate a retail management system, being aware of how remittance functions can help you manage your finances effectively.

What Does Remit Payment Mean?

The term remit payment in invoices or financial documents indicates that the sender must receive payment according to the agreed terms.

In simpler words, remit payment means sending money to the right person to pay for goods, services, or any financial obligation.

The transaction can occur among individuals, businesses, or even between countries.

In a case in point, when a supplier issues an invoice to an importer for an amount of $5,000 with a note on it indicating that the importer should remit the sum of money to the supplier immediately, it implies that the importer would have to remit the payment to the supplier at the earliest opportunity.

Remit payments, therefore, do not merely entail the transfer of money but the right procedure, paperwork, and time to ensure that the money is transferred to the appropriate person or account.

The Meaning of “Remit” in Banking and Business

The remittance, meaning in bank terminology, is simple: it is the transfer of money between parties. In banking, people make remittances within a country or across borders to pay invoices, settle debts, or send money to relatives.

In business, companies usually use the word “remit” on invoices to show where and how the payment should be sent.

It refers to the account or address to which the payment has to be forwarded. An example of such a company could be:

Pay to: ABC Ltd., 123 Business Ave, New York, NY.

This assists companies and customers in knowing how and where to remit money.

Experts find remit payments very important because they help maintain accurate records. They record every remitted payment as proof of a completed transaction, which helps prevent disputes or mistakes in financial accounting.

What Is a Remittance?

A remittance refers to an exchange of funds between a business or an individual. It may occur at a local or cross-border level.

Remittances are of two categories:

- Personal remittances: These are usually remittances that are sent by individuals who are living in foreign countries to their fellow countrymen.

- Business remittances: Remittances that are paid among businesses to pay invoices or debts.

In both cases, the process keeps financial transactions safe and well recorded. The digital platforms have made remittance payments quicker, safer, and more transparent than ever before.

How Does a Remit Payment Work?

Remit payments usually follow a few simple steps, even though people often see the process as complex.

Invoice or Payment Request: the receiver sends an invoice or a note requesting payment (often with a note to the effect of remit payment written on it).

- Payment Details: The payer checks the payment details, which include the account number, customer ID, or invoice code.

- Selection of Payment Method: The payer determines the way in which to transfer the money, be it through EFT, SWIFT transfer, or a digital wallet.

- Transfer of Funds: The payment is made using the platform selected.

- Confirmation and Documentation: Confirmation is made by the receiver, and the payer puts a copy of the receipt in place of payment.

What Is The Pay and Remit Difference?

Pay and Remit to address meaning are used interchangeably, though they are not the same.

Pay is an overall word that merely implies one giving money for something.

Remit is a more corporate term and usually refers to an official or documented payment linked to an invoice or contract.

For instance:

You buy your coffee in a coffee shop.

You pay your supplier for a delivery of goods.

Simply put, all remittances are payments, but not all payments are remittances.

Remittance and Transfer Difference.

These two seem to be similar as well, yet they differ in terms of financial systems.

- Transfer: Any transfer of money between accounts, such as sending money to a friend.

- Remittance: A particular form of transfer that involves settling of debts, bills, or invoices, frequently in a business or international setting.

An example is paying an electrical bill, which is a remittance, but moving the money to a friend and having lunch is a money transfer.

With this difference, the business environment can have a better way of conducting financial operations and following the rules in international business activity.

Common Methods of Remitting Payments

There are numerous ways of remitting payment nowadays, and the most appropriate one depends on what you need, that is, the speed, the cost, and the convenient features.

a. EFT (Electronic Funds Transfer)

One of the popular business local payment options. EFTs are safe and fast, which means that companies can transfer funds out of one bank account to another.

b. SWIFT Transfers

SWIFT transfers are used in international transactions, and they bind world banks together. They are a little slower, but can be trusted and followed.

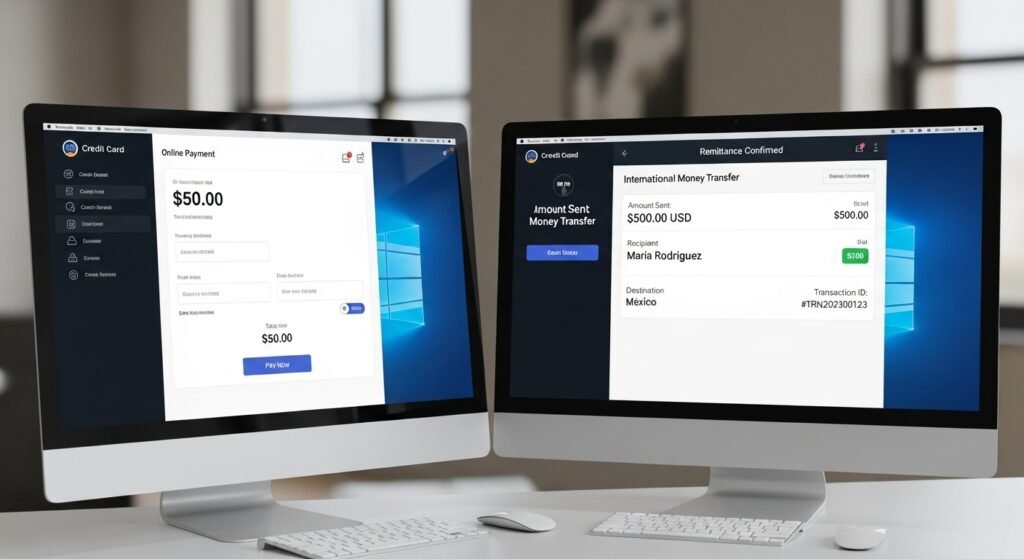

c. Online Payment Platforms

The ease of payment is enhanced by the digital payment providers, who do not have rigid banking hours and provide multi-currency and faster remittance payments.

d. Credit Card Payments

Best suited for recurring payments, e.g, Subscriptions or invoices that require rapid processing.

e. Cash Transfer Providers

Western Union or MoneyGram are among the services that are regularly used when remitting money between countries on a personal basis.

Through these approaches, the users have the freedom of selecting the one that suits their payment and budgetary plan.

How to Send a Remittance Step-by-Step

In the case of the first remittance, a simple breakdown is the following:

- Take the Invoice: The supplier issues an invoice, which is usually printed with a great sign of Please pay us at once.

- Choose a means of payment: EFT, SWIFT, or an online platform.

- Add Details that are required: Add invoice number, customer ID, or reference code.

- Transfer Funds: Pay the transaction using your bank or platform.

- Confirm and Save Proof: It is always a good idea to keep the payment confirmation or receipt.

This will make the transaction traceable and safe, particularly when making payment transactions in a large business or between two countries.

Can Payment Banks Handle Remittances?

Yes, payment banks can handle remittance transactions. They also provide facilities such as EFT, SWIFT, and online payment gateways to manage local and international payments.

Nonetheless, due to the emergence of digital payment systems, most companies are now adopting the use of digital wallets due to their expediency, convenience, and the numerous currencies that they can handle.

Companies use platforms to facilitate remittance transfers in and out more safely and cost-effectively than traditional banks.

Advantages of Using Payment Remittance Services

A good portion of the business in the modern world is dependent on the use of third-party remittance services rather than doing everything internally. The services have a number of advantages:

- Rapid processes: With high-level digital infrastructure, the process of payments is achieved quickly.

- Proper documentation: All the payments are documented and traceable.

- Multi-currency support: This is handy in carrying out international transactions involving different currencies.

- Fewer workloads: Automation lowers accounting operations and mistakes.

- 24/7: Digital systems are not subject to the banking hours.

These are time-saving, as well as financial transparency features, to comply with and trust.

Not yet wealthy enough to manage your money? Get assistance from the Net Income Zone and learn how to diversify your financial profile and do it wisely, through simple tips and with professional strategies.

Factors to Consider When Choosing a Remittance Provider

When choosing a remit payment platform to use in your business, these are some of the things to consider:

- Fees and Commissions: Shop around platforms.

- Speed of Transfer: Select one that is instantaneous in payments.

- User Experience: It has a simple and user-friendly dashboard that enhances workflow.

- Security Standards: Find suppliers that comply with global data protection regulations.

- Multi-Currency Options: Necessary for businesses that are global.

Providers pack this combination together, and these are suitable for businesses that require secure, compliant, and quick financial solutions.

Why Remit Payments Matter to You.

Remit payments are not mere technical terminologies, but they touch on people and economies on a day-to-day basis.

For Individuals:

The remittances provide life support to millions of families across the globe. They assist in financing food, education, and health. Expatriates back home remit money to their relatives and, thus, remittance remains an important factor in enhancing the welfare of the globe.

For Businesses:

Companies use remit payments in their daily operations. They pay invoices, clear debts, and maintain strong supplier relationships through them. A smooth remittance system helps businesses build financial reliability and manage cash flow effectively.

For Economies:

Remittances in the world promote local markets, small businesses, and alleviate poverty. Remitted funds, especially to developing countries, spur small business growth and the development of communities.

In a nutshell, remit payments strengthen personal and business finances and boost both business and economic stability.

Remit Payment in Retail and Digital Systems

Remit payments are important in the day-to-day running of a retail management system. The process of a store taking in inventory with a supplier requires the store to pay the supplier first before replenishing the store.

Innovations in the retail industry today incorporate payment remittance to provide automation to invoices, reminders, and cross-border payments. This saves time and also avoids the delays in making payments that may interfere with the supply chain.

The digital transformation has enabled remittance payments to be quick, transparent, and trackable, making the business operations run smoothly.

Conclusion

So what does remit payment mean? It simply involves sending money in order to pay an invoice, settle a debt, or even transfer funds in an official manner. It is a basic step in personal and business finance, and assists in preserving confidence, truth, and accountability.

Remittance eases the flow of money around the globe, whether through banks or via the digital platform. It is the foundation of the current financial systems that keep families alive and businesses going, and economies running. With the growing technology, it is possible to make your financial procedures more effective, quick, and open with the help of a secure and reliable remittance payment system.

Stop not, become wiser with money! From the Net Income Zone, you can find some real possibilities to diversify and balance your income functions to build a better financial future.

FAQs

1. What does remit payment mean?

Remit payment simply means the act of sending money to a person in order to pay a bill, or a debt, or to finalize a purchase. It formally involves moving money between individuals or organizations, usually linked to an invoice or contract.

2. What is the meaning of please remit payment on an invoice?

On an invoice, when you see please remit payment it is asking the company to have you remit the payment within the due date. It is nothing more than a reminder to pay with the information available.

3. What is the distinction between pay and remit?

Pay can be defined as giving money as a general term on something. Remit is more official and tends to refer to sending money to pay an invoice, a debt, or an official purpose. Therefore, payment is any remittance, but not every payment is a remittance.

4. How can I make a remit payment?

You can make a remit payment through a bank deposit, electronic transfer, wire, credit card, or any other online payment system. Select the appropriate method, fill in the appropriate invoice or account details, and verify the transaction.

5. What is the significance of remit payments?

Remit payments enable individuals and companies to use money in a safe and proper manner. They simplify the payment of bills, settling debts, and money transfer around the globe. Family-wise, remittances provide them with a stable source of income and finances.

Emily Roberts is a chartered accountant and financial advisor who specializes in income tax and small business compliance. She writes to simplify complex tax concepts for everyday readers.