Every business wants to know one simple thing: “Are we really making money from what we sell?” To answer that question, companies use a special report called the contribution format income statement. It is a simple yet effective tool that assists business owners in knowing the contribution of each product or service to a business’s profit.

Our entire 2025 guide will explain what a contribution format income statement is, how to create one, why it is better when compared to traditional income statements, and why it is so important.

Let’s dive in.

What Is a Contribution Margin Income Statement?

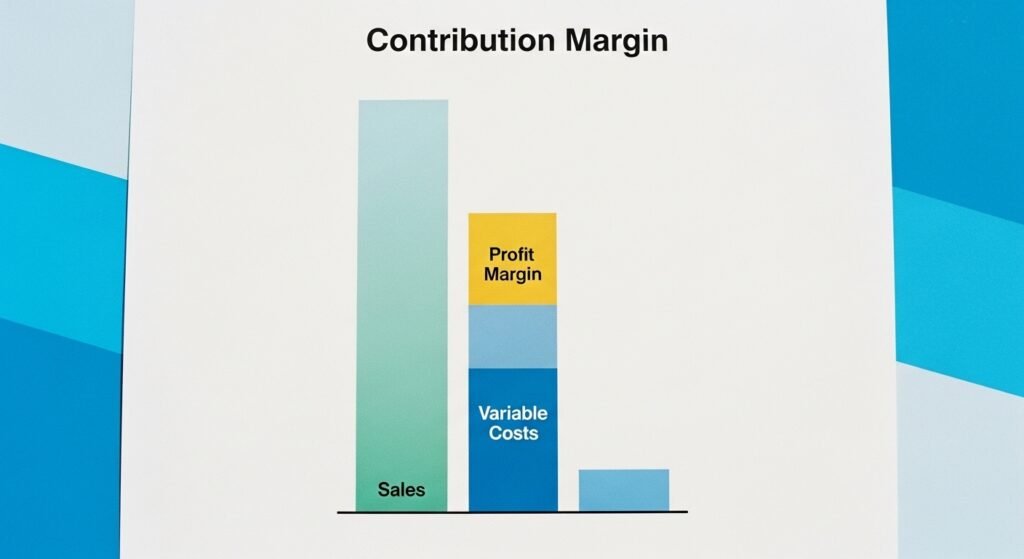

A contribution margin income statement indicates the amount of money that a company retains after taking into account all its variable costs (costs which vary with sales or production).

And it is not exclusively about overall profit, but also about understanding how any given product or service can contribute to overall fixed cost recovery as well as additional income.

There are two types of costs in this statement:

- Variable costs: Costs that are affected by the quantity of products produced or sold (such as materials and wrappings).

- Fixed costs: Costs that stay the same no matter how much you sell (like rent or salaries).

When you subtract variable costs from sales, you get the contribution margin. After that, you subtract fixed costs to find the net profit.

It’s simple but gives a deep view of how well each product line performs.

Why Does It Matter?

The contribution margin income statement helps businesses see:

- Which products are most profitable?

- Which ones might need to be stopped or improved?

- Where costs can be cut.

- How to set better prices.

- How much must be sold to break even?

For example, imagine a shoe company like Nike. It sells hundreds of designs. Using this statement, the company can see which shoes bring in higher margins and which ones eat up resources. That’s how big brands decide what to promote or discontinue.

It’s like a profit map for your small-scale industries, showing which products are gold mines and which are draining money.

What Is a Contribution Margin?

A contribution margin is the margin between the sales revenue and the costs incurred.

Formula:

Contribution Margin = Sales Revenue- Variable Costs.

It informs you about the remaining amount of money to cover the fixed costs and gain profit.

Let’s make it even simpler:

When selling one item at a selling price of 100, and its cost of production is 60 (materials, labor, and packaging), then your contribution margin will be 40.

That 40 will help in covering rent, salaries, and ultimately profit.

Why It Matters

When the contribution margin is high, this implies that you make more profits on each sale. It is a kind of heavier security net; in case of decreased sales, it will still be possible to keep your business in place.

However, when your margin is below a certain level, then that is an indication that a large part of your income is spent on the production of the product. There is minimal profit in that.

What Does A Contribution Format Income Statement Do?

The contribution format income statement is designed in a special format, which is not focused on functions but on cost behavior.

Here’s the structure:

- Sales Revenue

- Minus Variable Costs

- Equals Contribution Margin

- Minus Fixed Costs

- Equals Net Profit (or Loss)

The layout is simple to read and provides a clear view of how the sales and the costs interrelate.

Even though in the traditional income statement, costs are separated into operating and non-operating groups, the contribution format deals with the characteristic of costs, which either increase or decrease along with sales or remain constant.

Internal decision-making is the primary application of it by managers and business owners, not to produce external reports.

Example Of How To Make A Contribution Margin Income Statement

I would like to consider a straightforward example of a beauty company that sells skincare products.

| Item | Amount ($) |

| Revenue | 100,000 |

| Variable Costs | 50,000 |

| Contribution Margin | 50,000 |

| Fixed Expenses | 25,000 |

| Net Profit | 25,000 |

Here’s what’s happening:

- The company made $100,000 in sales.

- It incurred a variable cost of 50,000 (materials, packaging, commissions).

- That will give a margin of contribution amounting to fifty thousand dollars.

- It makes a net profit of $25,000 after deduction of fixed costs (rent, salaries).

This simple structure gives a very clear view of how much money each sale actually brings into the business.

Sounds overwhelming? Take help from Net Income Zone and learn to budget, save, and grow your income with fun, easy lessons designed for real-life success.

How To Calculate a Contribution Format Income Statement

Let’s go step by step.

Step 1: Find Your Sales Revenue

Sum the amount of money you got selling your products during a certain time (month or quarter).

Step 2: Identify Your Variable Costs.

Identify all costs that increase/ decrease with an increase in sales, such as raw materials, direct labor, commissions, and packaging.

Step 3: Use the Formula

Contribution Margin = Sales Revenue- Variable Costs.

Step 4: Determine Contribution Margin Ratio.

Contribution Margin Ratio =(Contribution Margin/ Sales Revenue) x 100.

This will give you the percentage of each sale that is used to pay the fixed costs and make a profit.

Example:

An example would be a skincare company selling 1,000 units priced at $50 a unit = $50,000 of revenue.

Variable cost per unit = $28 →Unit variable costs = 28,000.

Contribution Margin = $50,000 – $28,000 = $22,000.

Now divide:

$22,000 ÷ $50,000 = 0.44, or 44% margin.

That is, 44 percent of every sale will cover the fixed costs and profit.

How to Fill Out a Contribution Margin Income Statement

Now let’s make your own!

Step-by-Step Guide

- Choose the period (monthly, quarterly, yearly).

- Write total revenue.

- List all variable costs.

- Subtract variable costs from revenue to get your contribution margin.

- List all fixed costs.

- Subtract fixed costs from the contribution margin.

- The final number is your net profit or loss.

Example Layout:

| Item | Income ($) | Expenses ($) | Total ($) |

| Revenue | 100,000 | ||

| Variable Costs | 50,000 | ||

| Contribution Margin | 50000 | ||

| Fixed Costs | 25000 | ||

| Net Profit | 25000 |

This layout gives a quick and easy snapshot of your business performance.

Tip: Many companies use financial software (like Cube Software) to calculate these automatically and save time.

Contribution Format vs. Traditional Income Statement

Let’s see how they’re different:

| Feature | Contribution Format Income Statement | Traditional Income Statement |

| Cost Type | By behavior (fixed vs. variable) | By function (COGS, admin, etc.) |

| Main Use | Internal management | External reporting |

| Key Measure | Contribution Margin | Gross Profit |

| Best For | Break-even and cost analysis | Investor and regulatory reports |

Why This Difference Matters

The contribution format tells you how much profit each product brings in.

The traditional format tells outsiders (like investors) the company’s overall performance.

So, while both are important, the contribution format helps you make everyday business decisions faster.

Contribution Margin vs. EBIT and EBITDA

Some people confuse contribution margin with Earnings Before Interest and Taxes (EBIT) or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Let’s keep it simple.

| Term | Meaning | Focus |

| Contribution Margin | Sales minus variable costs | Product-level performance |

| EBIT | Sales minus all operating costs | Company-level profit before tax |

| EBITDA | EBIT plus Depreciation & Amortization | Cash flow from operations |

Example Calculation

If:

- Revenue = $100,000

- Variable Costs = $50,000

- Fixed Costs = $25,000

- Depreciation = $5,000

- Amortization = $5,000

Then:

- Contribution Margin = $50,000

- EBIT = $25,000

- EBITDA = $35,000

Each number gives a different view of financial health. The contribution margin helps you zoom in on each product’s performance, while EBIT and EBITDA show the company’s overall health.

How to Use the Contribution Format for Better Decisions

Here are some practical ways companies use it:

- Pricing decisions: Know if you can afford to lower prices or need to raise them.

- Product mix planning: Focus on products with higher margins.

- Cost control: Find which variable costs are too high and need trimming.

- Break-even analysis: Learn how many units you must sell to cover all costs.

- Profit forecasting: Plan for next quarter based on margin trends.

It’s not just accounting, it’s strategic decision-making made easy.

Common Mistakes to Avoid

Even simple statements can go wrong. Watch out for these:

- Mixing up fixed and variable costs.

- Forgetting indirect variable costs (like commissions).

- Using inconsistent time periods for revenue and costs.

- Ignoring seasonal cost changes.

- Not updating data regularly.

Using proper financial tools or accounting software reduces these risks.

Final Thoughts

Think of your contribution format income statement as a financial mirror. It shows which parts of your business are healthy and which need attention.

With this report, you can:

- Make confident business decisions.

- Control costs better.

- Plan for sustainable profit growth.

In short, it’s one of the easiest and most effective tools to understand your business’s true financial picture.

So the next time you review your finances, remember this golden rule:

Revenue tells you how much you sell. Contribution margin tells you how much you actually earn.

At Net Income Zone, you can discover numerous practical, beginner-friendly tips to manage your finances wisely, cut unnecessary costs, and make your money work harder for you, not against you.

FAQs

1: Can a small business use a contribution format income statement?

Yes. In fact, small businesses may benefit a lot because it helps them see clearly how their products/services perform and where to cut costs or raise prices.

2: Is contribution margin always higher than gross profit?

Not necessarily. They’re different metrics. Contribution margin subtracts variable costs (not just cost of goods sold) and is used for internal decision-making. Gross profit subtracts the cost of goods sold (COGS) and is used for external reporting.

3: What if fixed costs change every month?

Then, fixed costs for each period must be captured correctly. If fixed costs vary (for example, due to seasonal lease changes), treat them in the period they occur so your statement is accurate.