Taxes are an element of the financial existence that can not be surrendered. It is significant to pay them on time; however, there is a weakness in people falling behind. Taxing authorities can then use resources to recover what is due when that occurs. A tax warrant is one of the most powerful mechanisms that they employ.

In case you have ever asked yourself the question What is a tax warrant, or in case you got a tax warrant notice, then this guide is exactly what you need. Learning these words and their meanings, the taxpayers will be able to prepare against them and not face the situation of having enforcement actions taken against them.

Such warnings should not be ignored because their financial consequences may be severe, so in case any problems might remain outstanding, it is essential to find solutions as quickly as possible and seek advice if required.

What Is a Tax Warrant?

A tax warrant refers to a legal document that is issued by a tax body, e.g., the IRS or a state body, in case of nonpayment of the taxes that were supposed to be paid by a tax homeowner. It does not only mean a mere order but a statutory right by means of which the state can claim unpaid taxes by using stronger measures.

Key Points About a Tax Warrant:

- It is a public record that can affect your credit.

- It gives the tax authority the power to seize property or garnish wages.

- It acts as an official warning that tax debt is being enforced legally.

In short, a tax warrant is a serious matter. It means your unpaid taxes have reached the point where authorities are taking collection actions.

How a Tax Warrant Is Issued

The procedure to be taken in the issuance of a tax warrant normally goes as follows:

- Tax Assessment: The tax collector calculates the amount of taxes to be paid.

- Notice of Assessment: This is an official notice received by the taxpayer on how much he or she has to pay and on which date.

- Demand for Payment: Once the taxpayer has neglected the notice, he/she is issued a formal demand for payment.

- Tax Warrant: A Tax warrant is issued and published in case of no payment yet.

What this means is that there will have been a number of reminders and notices given to you before a warrant makes an appearance.

Different Types of Tax Warrants

Not all tax warrants are the same. Here are the common types:

- A State Tax Warrant is issued when state taxes go unpaid. The state may take action against property or income.

- A Federal Tax Warrant is issued by the IRS for unpaid federal taxes. It can also lead to wage garnishment or bank levies.

- A Property Tax Warrant is issued when property taxes are unpaid. Can result in a lien on your home or even foreclosure.

- An Income Tax Warrant is often linked to unpaid income taxes, with penalties and collection actions.

Each type carries serious risks. Knowing the type of warrant you face helps in planning the right response.

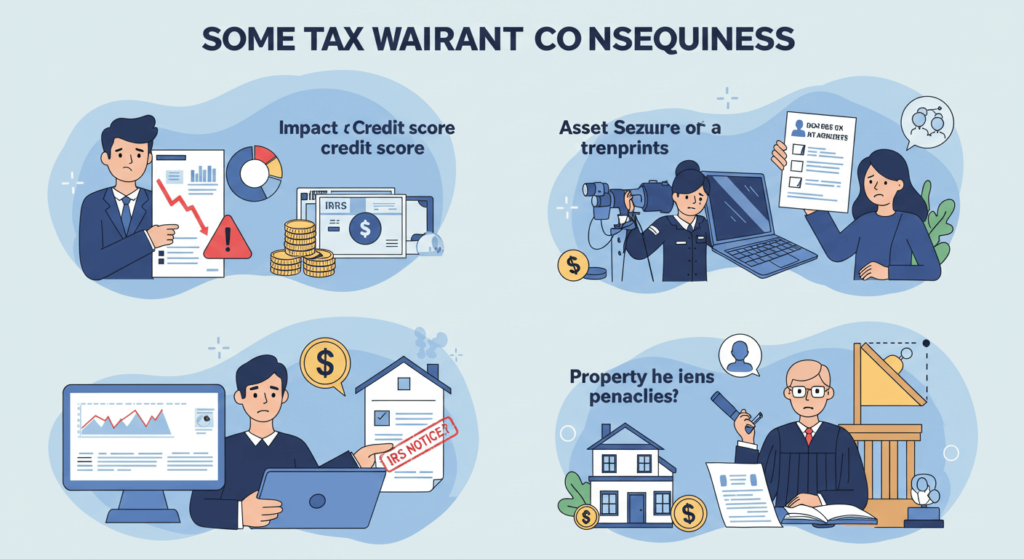

What Are Some Tax Warrant Consequences

Receiving a tax warrant can create multiple financial and legal problems. Let’s look at the most common tax warrant consequences:

1. Impact on Credit Score

A tax warrant has adverse consequences to your credit score and is typically recorded on your credit reporting record for the next 7 years after the tax is fully paid. A tax warrant will also be a public document, and it will appear during any search conducted into the details of an individual and/or a business. This reduces your credit score, and getting loans and credit cards, or even housing, becomes difficult.

2. Asset Seizure

Authorities can seize assets like vehicles, bank accounts, or property to cover unpaid taxes.

3. Wage Garnishment

Part of your paycheck can be withheld automatically to pay your tax debt.

4. Property Liens

A lien can be placed on your home or land. You cannot sell or refinance until the lien is cleared.

5. Legal Penalties

Ignoring a warrant adds more penalties and interest. It may even lead to lawsuits in extreme cases.

Clearly, a tax warrant should never be ignored. The faster you act, the better chance you have to reduce the damage.

Signs You May Receive a Tax Warrant

It is always better to prevent a problem than to fix it later. Here are some signs that you may be at risk of receiving a tax warrant notice:

- Multiple IRS or state letters about unpaid taxes.

- Aggressive collection actions like liens or levies.

- Large outstanding tax balances that are unpaid.

- Ignoring previous tax obligations for months or years.

If you notice any of these signs, it is time to take action before things escalate to a warrant.

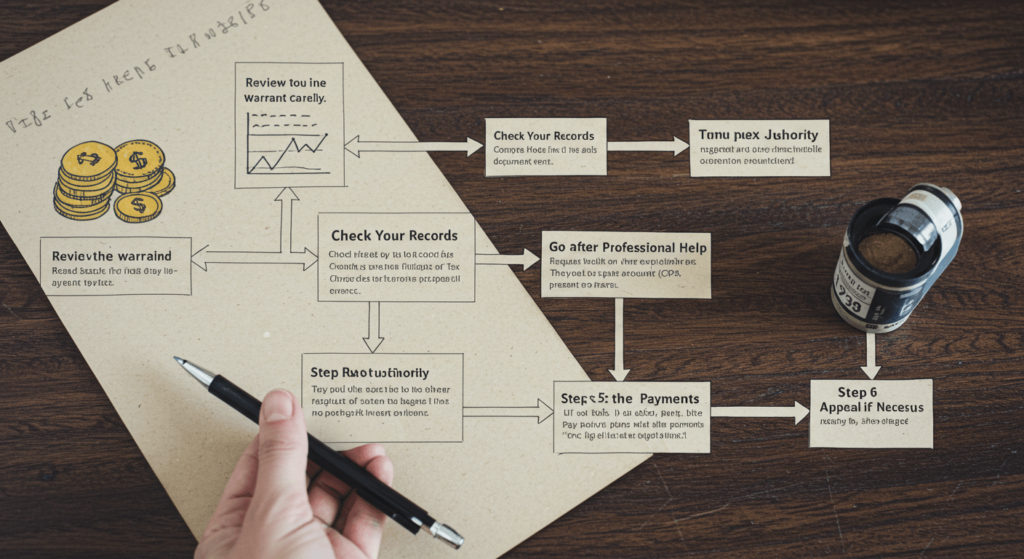

Steps To Follow After Receiving a Tax Warrant

If you have received a notice, don’t panic, but don’t ignore it either. Here are the most important steps after receiving a tax warrant:

Step 1: Review the Warrant Carefully

Read the warrant line by line. Understand how much you owe and what assets may be at risk. Check for any errors in the details.

Step 2: Check Your Records

Compare the warrant to your tax filings and financial documents. At times, there are errors. In case you detect some irregularities, present evidence.

Step 3: Contact the Tax Authority

Contact the warrant-issuing agency. Request an explanation and negotiate the potential solutions. Communication will not happen by chance.

Step 4: Go after Professional Help

A tax attorney should be hired either on a warrant or a certified public accountant (CPA). They are knowledgeable of the tax laws and are able to bargain with the IRS or even the state agency.

Step 5: Discussing the Payments

Pay in full, if you are able. If not, ask about payment plans or settlements like “offers in compromise.”

Step 6: Appeal if Necessary

If you believe the warrant was issued in error, you may have the right to appeal. A tax attorney can guide you through this process.

List Of Your Rights as a Taxpayer

Even when facing a tax warrant, you still have rights:

- The right to be informed about the warrant and the debt.

- The right to challenge or appeal the warrant if you believe it is wrong.

- The right to payment plans that fit your financial situation.

- The right to hire representation, such as a tax attorney.

Knowing your rights helps you deal with the situation more confidently.

The Role of a Tax Attorney for Warrants

A tax attorney for warrants can be your strongest ally when dealing with tax debt. Here’s how they help:

- They review your tax situation and confirm if the warrant is valid.

- They negotiate with tax authorities on your behalf.

- They may help you reduce penalties and interest.

- They guide you on appeals and protect your rights in court if needed.

Without a financial advisor’s help, you may miss opportunities to settle the issue with less financial damage.

How To Avoid Tax Warrant Issues

The best strategy is to prevent tax warrants altogether. Here are some ways of avoiding tax warrant issues:

- Pay Taxes on Time: Always pay before deadlines to avoid penalties.

- File Accurate Returns: Double-check your tax return for mistakes.

- Keep Records: Maintain proper documents of income, deductions, and payments.

- Work with a Tax Professional: Get advice regularly to avoid errors.

- Respond to IRS Notices Quickly: Don’t ignore warning letters.

A little proactive effort with financial advisors can save you from the stress of a warrant.

How Tax Warrants Affect Your Finances

One major worry people have is how a warrant will affect their money. The reality is, tax warrants can create long-term financial setbacks:

- Credit damage can last for years.

- Selling property becomes difficult with liens.

- Seized assets may never be recovered.

- Interest keeps growing until the debt is cleared.

This is why it is critical to address a warrant as soon as possible.

Final Thoughts

So what is a tax warrant? It is an effective legal instrument that is implemented by tax authorities to seize untaxed dues. It may result in liens, wage garnishment, seizure of assets, and financial problems in the future.

This is because working with a tax attorney or CPA can help save you a big time loss. Meanwhile, address the avoidance of tax warrant issues by making tax payments, document retention, and performing a timely response to notices issued.

Taxes are necessary, and it always pays off to be proactive with Net Income Zone.

FAQs

1. What is the life of a tax warrant once entered on the public record?

A tax warrant tends to remain on record, whatever it is, until the debt is actually paid or formally cancelled by the taxing authority. Although it is solved, it can still be apparent in the records for several years, which will hinder some credit and financial dealings.

2. Is it possible that a tax warrant impacts my business license?

Yes. Many states will deny your license or permits in case your business has an outstanding tax warrant, and your license or permits may be suspended along with the Department of Motor Vehicles until this tax debt is paid. This can have a direct effect on your operation in terms of legality.

3. Is a tax warrant a threat of jail?

No, a tax warrant is not, in itself, jail. It does not turn into criminal charges; it just collects money. Nevertheless, in case the tax fraud or deliberate avoidance is established, additional legal consequences may include criminal punishment.

4. Is it possible to negotiate a tax warrant?

Yes. Tax collectives usually give a chance for negotiations, in case you are unable to settle the entire receipt immediately. Through a tax attorney or CPA, you can be eligible for a settlement, payment plan, or mitigated penalties.

5. What happens when I promote a property containing a tax warrant lien?

When you attempt to sell property that is listed with a tax lien, the lien can not be paid after the fact. The sales proceeds are liable to the tax authority, and thus, you cannot transfer all ownership until it is paid.and thus, you cannot transfer all ownership until it is paid.

Michael Adams is a professional finance writer with a focus on tax education, budgeting, and personal finance. His goal is to make income tax topics clear and practical for individuals and entrepreneurs.